Portland Real Estate Market Update

2013 showed big gains in Portland’s real estate market. The average sales price in the metro area increased nearly 13% from $275,000 to $310,000. Since the end of 2011, prices have been trending upward and nearing 2007 values in most close-in neighborhoods. We expect prices to continue to rise, but at a more moderate rate as 2014 kicks off.

2013 showed big gains in Portland’s real estate market. The average sales price in the metro area increased nearly 13% from $275,000 to $310,000. Since the end of 2011, prices have been trending upward and nearing 2007 values in most close-in neighborhoods. We expect prices to continue to rise, but at a more moderate rate as 2014 kicks off.

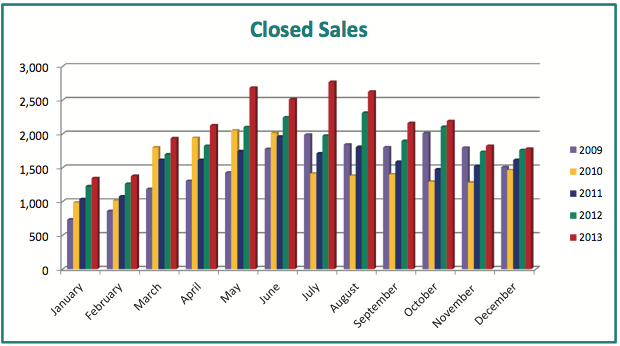

There are many contributing factors to the increasing price of local real estate. One of those is simply the relatively low amount of homes for sale. Inventory takes in to account the number of active listings and the rate of sale for the month. Portland Metro began the year with 4.7 months of inventory, dropped as low as 2.5 in May amidst quick sales and bidding wars, and ended the year slightly back up at 3.2 months. Keep in mind that since inventory takes into account the rate of sale, and less buyers are house shopping in the winter, a higher inventory doesn’t mean there are more homes on the market. For instance, May chalked up 2,682 closed sales with a lower inventory than the 1,782 closed sales in December.

So with all this in mind, what’s the best real estate move in today’s market? When prices were low and interest rates were around 3.5% it was clearly time to buy, buy, buy! Now, prices have recovered and we don’t expect as rapid of price increases as seen during 2012 and 2013.

For the homeowner that has been waiting to sell because they didn’t want to miss out on potential equity, now’s the time to take another look at selling and their home’s value. A prudent move in today’s market is to downsize. Selling a home with recently recovered equity at an attractive price, and using that equity toward a down payment on a smaller or less expensive home is a safe bet! Interest rates are fluctuating in the mid 4% range, which is sure to increase, so locking in a long-term mortgage with a comfortable payment now could be beneficial for years to come.